The apartment hunt can feel overwhelming with all the research and decisions that lie ahead. Before diving into the search, it’s crucial to establish a clear starting point: How much rent can I afford? While it’s tempting to explore every available option in your desired area, understanding your budget upfront is essential for a realistic search and successful move-in!

While it may seem contradictory, renting an apartment is not just about what you can afford; landlords and property managers have their own income thresholds they require before approving you as a tenant. They want to ensure that you have the financial means to consistently pay rent on time. On average (nationally), most landlords/property managers require prospective tenants to make a monthly gross income that is 3x the base rent. Of course, this threshold is highly dependent on the landlord, location, and other factors. Some markets like NYC can get as high as 40x (annually)!

As you begin your apartment hunt, it’s important to remember that the apartment is an expense that is supposed to fit into your budget. You don’t want to make the mistake of budgeting all of your finances for the apartment. Instead, it should seamlessly integrate into an overall budget that is sustainable.

Let’s dive in and help you determine how much rent you can afford!

Housing is just a part of your budget

In order to build your wealth and financial future, it’s imperative to recognize that your apartment is just another line item expense in your budget. We’ve created a guide that walks you through how to budget for an apartment – this will give you a sense of how much renting an apartment truly is (beyond just base rent) to help you plan more effectively.

It’s in your best interest to take a look at your overall budget and make the apartment fit into it without compromising your comfort and or future. You still want to prioritize essentials such as building an emergency fund, trying to save monthly, paying off any debts or loans, and managing recurring expenses.

If you can, a best practice is to immediately take out what you want to save from your monthly net income (take-home pay) before anything else. Now you have an operating budget that has already factored in building your financial future!

30% rule

The U.S. Bureau of Labor Statistics reported that the average American household spends 33% of income on housing (*as of 2022). Expenditures on both rented dwellings and owned dwellings increased by 6.5% and 8.4%, respectively (from 2021 to 2022). Therefore, it’s no coincidence that experts recommend renters spend no more than 25% to 30% of their gross monthly income on rent. However, your individual circumstance will determine the appropriate allocation for you.

If you want a fast and simple answer as to how much you should spend on rent, use the rent-to-income ratio. This is a financial metric used to assess how much of a person’s income is dedicated to paying rent. It’s calculated by dividing the monthly rent payment by the gross monthly income. For example, if someone earns $4,000 per month and pays $1,000 in rent, their rent-to-income ratio would be 25% ($1,000 / $4,000).

If you’re wondering how to calculate your gross income to utilize this ratio, here’s a breakdown: Gross income, also called gross pay when it’s on a paycheck, is an individual’s total earnings before taxes or other deductions. This income comes from all sources – including side hustles, investments, government benefits, etc. So, if you earn $3,000 per month from your job and $500 per month from freelance work, your total gross income would be $3,500 per month.

PRO TIP: If your monthly income fluctuates – budget based on your lowest typical monthly income, not your highest. Your income may vary but your rent doesn’t, and you need to afford it even in a down month. Afterall, this is how the landlord/property manager is going to calculate your income when screening you!

The 30% rule for rent allocation serves as a widely recommended guideline to maintain financial balance, reflecting the average expenditure on housing for many households. However, it’s important to recognize that individual circumstances vary, and while this rule offers a very helpful starting point, it may not suit everyone’s unique financial situation!

50-30-20 rule

If you’re looking for an alternative method to determine how much you should spend on rent, consider the 50-30-20 rule. This rule advises renters to allocate 50% of their budget to necessities, designate 30% for desires, and set aside 20% for savings. There are many benefits to this approach:

Unlike strict percentage guidelines such as the 30% rule, the 50-30-20 rule offers more flexibility by allowing for varying financial situations and personal preferences. It recognizes that individuals may have different priorities and financial goals, which gives them the ability to customize their budget accordingly.

Additionally, there is a clear priority for savings. This emphasis encourages individuals to build emergency funds, pay off debt, invest for the future, and achieve other financial objectives while meeting housing needs.

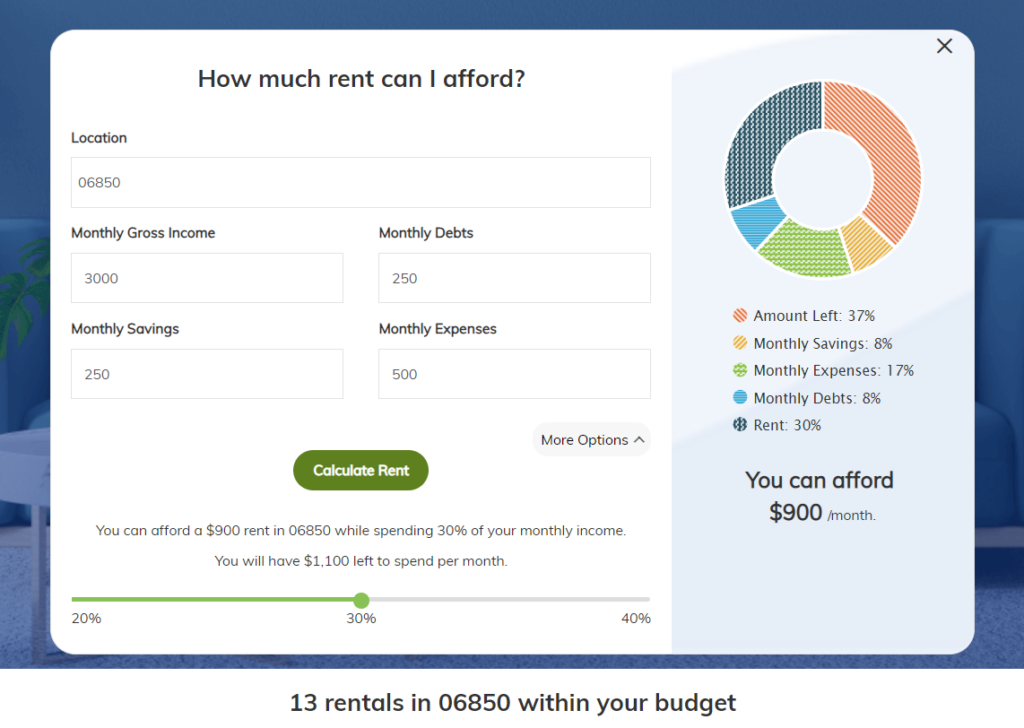

Rent affordability calculator

A great way to visualize how much you can spend on rent, is with a rental calculator. We recommend RentCafe’s Rent Affordability Calculator. Here’s why:

- You can customize the percentage of monthly gross income allocated toward rent, which helps you assess what is best for your overall budget.

- It gives you a breakdown of how your monthly income is distributed when all is said and done (top right).

- You can input the zip code of the market you are interested in, and it will show you rental listings that match your affordability!

This is such an invaluable tool in determining an appropriate rent tailored to your specific financial situation. With customizable options, detailed income breakdowns, and location-based rental listings; it gives you everything you need with one click.

What if I am just out of reach?

Sometimes you just cannot picture yourself in any other apartment. But, it stretches your budget just a little too far. Although you never want to put yourself in a financially straining position, we understand what it feels like to come across your dream apartment. We have a few creative ideas for you:

Find a roommate

Finding a roommate is a practical solution to make renting an apartment more affordable! Here’s how having a roommate can help:

- Splitting rent: Roommates allow you to divide the cost of rent, significantly reducing individual financial responsibility.

- Shared utilities: Sharing utilities such as electricity, water/sewer, and internet lowers monthly expenses for everyone in the apartment.

- Dividing household expenses: Roommates can split the cost of groceries, household supplies, and other communal expenses, making them more manageable for each person.

- Better options: With roommates, you can potentially afford a larger or better-located apartment that might otherwise be too expensive to rent alone.

- Shared responsibilities: Roommates can share household chores, reducing the need for outsourced services and saving money on cleaning, maintenance, and other tasks.

When considering a roommate, it’s not just about their ability to contribute financially. It’s equally important to choose someone you would enjoy living with and seeing every day. Making sure that your lifestyles and habits align can help prevent unnecessary conflict down the road.

Try to negotiate rent

Negotiating rent can be a delicate process, but with some preparation, you may be able to secure a better deal. Remember, this is extremely dependent on the landlord/property manager. It is generally much harder to negotiate rent in highly competitive markets, and in large apartment complexes. Although this is not always the case, it can be easier with smaller single-family rentals or townhomes. Here are a few realistic tactics to try:

- Research comparable rentals: Before negotiating, research similar rental properties in the same area. Knowing the market rates will give you leverage when discussing the proposed rent with your landlord.

- Highlight your positive rental history: If you have a good rental history, emphasize this. Landlords are often more willing to negotiate with tenants who have a track record of timely payments and responsible tenancy!

- Consider a longer lease term: Landlords value stability, so offering to sign a longer lease term in exchange for a lower rent can be attractive to them. This ensures a steady income for the landlord and reduces their turnover costs.

- Negotiate other terms: If the landlord is not willing to budge on the rent amount, try negotiating other terms of the lease, such as the security deposit amount, pet policies, or parking fees. Any reduction in overall payment helps.

Remember that negotiation is a two-way street, and compromise may be necessary. Be prepared to listen to the landlord/property manager’s concerns and be flexible in finding a solution that works for both parties. Negotiation does not always work, but it doesn’t hurt to try!

Use a guarantor

This is a tricky one, and you should be cautious with this option. A guarantor is someone who agrees to be financially responsible for the lease if the primary tenant fails to meet their rental obligations. They provide additional assurance to the landlord that the rent will be paid, often by demonstrating their own financial stability and creditworthiness.

Here’s the catch, guarantors are used when the individual cannot qualify for an apartment with their income alone. So, although you can secure the apartment with a guarantor, you’re still technically renting an apartment that is out of your financial means (since you could not qualify on your own). Now, this shouldn’t discourage you from proceeding with renting. Just know, you’ll have to seriously evaluate your financial circumstance, how you budget, and the lifestyle you plan on living.

We’ve helped many prospective tenants lease with guarantors, and they successfully navigate apartment renting within their budget because they are very strategic with their money and make conscious lifestyle choices that won’t hinder them in the future. As long as you’ve determined that this method makes sense for you, then it’s a great option!

Finding your rental sweet spot

Embarking on the apartment hunt can feel daunting, but understanding your budget sets you up for a successful outcome. While income thresholds set by landlords are important benchmarks, it’s equally vital to align the rent amount with your overall financial health and future goals. Whether adhering to traditional guidelines like the 30% rule or exploring alternative methods like the 50-30-20 approach, finding a balance that suits your individual circumstance is key. Utilizing tools like rental calculators can further empower you to make informed decisions and confidently navigate the rental market. Remember, with careful budgeting and planning, you can determine the rent that not only fits into your financial means but also supports your financial well-being!